|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Jan 08, 2014 |

referred to cultural affairs, tourism, parks and recreation |

| Jan 09, 2013 |

referred to cultural affairs, tourism, parks and recreation |

Senate Bill S1033

2013-2014 Legislative Session

Sponsored By

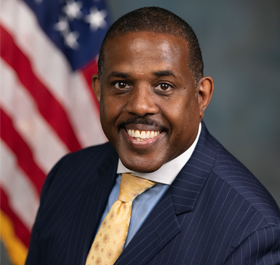

(D, WF) 29th Senate District

Archive: Last Bill Status - In Senate Committee Cultural Affairs, Tourism, Parks And Recreation Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

co-Sponsors

(D, WF) 21st Senate District

2013-S1033 (ACTIVE) - Details

- See Assembly Version of this Bill:

- A5972

- Current Committee:

- Senate Cultural Affairs, Tourism, Parks And Recreation

- Law Section:

- Parks, Recreation and Historic Preservation Law

- Laws Affected:

- Ren §13.31 to be §13.32, add §13.33, Pks & Rec L; add §1105-D, Tax L; add §92-t, St Fin L

- Versions Introduced in Other Legislative Sessions:

-

2011-2012:

S4277, A6272

2015-2016: S703, A1991

2017-2018: S3509

2013-S1033 (ACTIVE) - Summary

Creates the "Pennies for parks" program providing funds for capital expenditures at state parks and historic sites; imposes tax on single use carryout plastic bags; establishes the pennies for parks fund to hold funds received by the tax on single use carryout plastic bags.

2013-S1033 (ACTIVE) - Sponsor Memo

BILL NUMBER:S1033

TITLE OF BILL:

An act

to amend the parks, recreation and historic preservation law,

in relation to creating the "Pennies for

parks" program providing funds for capital expenditures at state parks

and historic sites; to amend the tax law,

in relation to imposing tax on single use carryout plastic bags; and

to amend the state finance law, in relation to

establishing the pennies for parks fund

PURPOSE OR GENERAL IDEA OF BILL:

To raise funds for capital

expenditures for our under-funded State park system.

SUMMARY OF SPECIFIC PROVISIONS:

This legislation would amend the

parks, recreation and historic preservation law, in relation to

creating the "Pennies for Parks" program providing funds for

capital expenditures at state parks and historic sites; to amend the

tax law, in relation to imposing tax on single use carryout plastic

bags; and to amend the state finance law, in relation to establishing

the pennies for parks fund.

JUSTIFICATION:

2013-S1033 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

1033

2013-2014 Regular Sessions

I N S E N A T E

(PREFILED)

January 9, 2013

___________

Introduced by Sens. SERRANO, PARKER -- read twice and ordered printed,

and when printed to be committed to the Committee on Cultural Affairs,

Tourism, Parks and Recreation

AN ACT to amend the parks, recreation and historic preservation law, in

relation to creating the "Pennies for parks" program providing funds

for capital expenditures at state parks and historic sites; to amend

the tax law, in relation to imposing tax on single use carryout plas-

tic bags; and to amend the state finance law, in relation to estab-

lishing the pennies for parks fund

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Legislative findings and intent. The legislature finds and

declares that state parks and historic sites enhance the character and

quality of life and enhance the economic vitality of local communities

and provide healthy and affordable recreational and educational opportu-

nities to New York state residents and visitors. If allowed to fall into

disrepair, state parks and historic sites may become inaccessible and

uninviting to the public. Once closed or sold, state parks and historic

sites are difficult, if not impossible, to recover or rehabilitate.

Accordingly, state parks and historic sites should be provided necessary

capital funding in a manner which is cognizant of their aforementioned

intrinsic values.

The legislature also finds and declares that the single use carryout

plastic bags distributed by New York retailers have a negative impact on

the environment, littering our communities, parks and beaches; filling

our landfills; harming wildlife; and using millions of gallons of oil to

produce. An additional economic incentive should be put in place to

encourage the use of reusable bags and reduce the stream of single use

carryout plastic bags.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD00526-01-3

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.