|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Feb 07, 2014 |

print number 2635a |

| Feb 07, 2014 |

amend and recommit to investigations and government operations |

| Jan 08, 2014 |

referred to investigations and government operations |

| Jan 23, 2013 |

referred to investigations and government operations |

Senate Bill S2635A

2013-2014 Legislative Session

Sponsored By

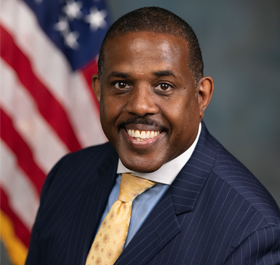

(D, WF) 21st Senate District

Archive: Last Bill Status - In Senate Committee Investigations And Government Operations Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

Bill Amendments

co-Sponsors

(R, C, IP) Senate District

(D, WF) 46th Senate District

(D, WF) 28th Senate District

(D, WF) Senate District

2013-S2635 - Details

- See Assembly Version of this Bill:

- A62

- Current Committee:

- Senate Investigations And Government Operations

- Law Section:

- Tax Law

- Laws Affected:

- Amd §§1101, 1115, 1107, 1109 & 1210, Tax L

- Versions Introduced in Other Legislative Sessions:

-

2009-2010:

S2541, A667

2011-2012: S1089, A5835

2015-2016: S762

2017-2018: S3410

2019-2020: S3588

2021-2022: S3334

2023-2024: S4949

2013-S2635 - Summary

Provides a tax exemption from sales and compensating use taxes on alternative energy systems including alternative energy systems, new Energy Star appliances and tangible personal property used in or on habitable residential and non-residential structure to improve energy efficiency; and defines relevant terms; authorizes municipalities to adopt the exemption.

2013-S2635 - Sponsor Memo

BILL NUMBER:S2635

TITLE OF BILL:

An act

to amend the tax law,

in relation to providing an exemption for alternative energy systems

from the state's sales and compensating use taxes

and authorizing

counties and cities to elect such exemption from their sales and use

taxes imposed by or pursuant to the authority of such law; and

providing for the repeal of such provisions upon expiration thereof

PURPOSE:

The legislation provides a tax exemption from sales and compensating

use taxes for alternative energy systems.

SUMMARY OF PROVISIONS:

Identifies alternative energy systems as new Energy Star appliances

and tangible personal property used in or on habitable residential

and nonresidential structures for the purpose of improving energy

efficiency. Such systems include systems which do not rely on

petroleum products or natural gas as their energy source, new Energy

Star appliances, and insulation, weather stripping, and products such

as roofing, windows, doors and skylights approved by the Energy Star

program.

2013-S2635 - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

2635

2013-2014 Regular Sessions

I N S E N A T E

January 23, 2013

___________

Introduced by Sens. PARKER, BONACIC, BRESLIN, KRUEGER, PERKINS, RANZEN-

HOFER, SERRANO, STAVISKY, VALESKY -- read twice and ordered printed,

and when printed to be committed to the Committee on Investigations

and Government Operations

AN ACT to amend the tax law, in relation to providing an exemption for

alternative energy systems from the state's sales and compensating use

taxes and authorizing counties and cities to elect such exemption from

their sales and use taxes imposed by or pursuant to the authority of

such law; and providing for the repeal of such provisions upon expira-

tion thereof

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subdivision (b) of section 1101 of the tax law is amended

by adding a new paragraph 39 to read as follows:

(39) ALTERNATIVE ENERGY SYSTEMS, NEW ENERGY STAR APPLIANCES AND TANGI-

BLE PERSONAL PROPERTY USED IN OR ON HABITABLE RESIDENTIAL AND NON-RESI-

DENTIAL STRUCTURES FOR THE PURPOSE OF IMPROVING THE ENERGY EFFICIENCY OF

SUCH STRUCTURES CONSIST OF: (I) SYSTEMS WHICH DO NOT RELY ON PETROLEUM

PRODUCTS OR NATURAL GAS AS THEIR ENERGY SOURCE OR FUEL CELL ELECTRIC

GENERATION EQUIPMENT AS DESCRIBED IN PARAGRAPH TWO OF SUBSECTION (G-2)

OF SECTION SIX HUNDRED SIX OF THIS CHAPTER; (II) NEW ENERGY STAR APPLI-

ANCES, INCLUDING RESIDENTIAL REFRIGERATORS, FREEZERS, CLOTHING WASHERS

(BUT NOT A COMBINATION WASHER/DRYER UNLESS THE CLOTHING IS WASHED AND

DRIED IN THE SAME COMPARTMENT), LIGHT FIXTURES WHICH USE A PIN-BASED

COMPACT FLUORESCENT BULB, NON-COMMERCIAL CEILING FANS OR CEILING FAN AND

LIGHT KITS, DISHWASHER OR AIR CONDITIONERS, SOLD AT RETAIL, PROVIDED

SUCH APPLIANCES QUALIFY FOR AND ARE LABELED WITH, AN ENERGY STAR LABEL

BY THE MANUFACTURER, PURSUANT TO AN AGREEMENT AMONG THE MANUFACTURER,

THE UNITED STATES ENVIRONMENTAL PROTECTION AGENCY AND THE UNITED STATES

DEPARTMENT OF ENERGY; AND (III) TANGIBLE PERSONAL PROPERTY THAT IMPROVE

THE ENERGY EFFICIENCY OF RESIDENTIAL AND NON-RESIDENTIAL HEATING AND

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD02974-01-3

co-Sponsors

(R, C, IP) Senate District

(D, WF) 46th Senate District

(D, WF) 28th Senate District

(D, WF) Senate District

2013-S2635A (ACTIVE) - Details

- See Assembly Version of this Bill:

- A62

- Current Committee:

- Senate Investigations And Government Operations

- Law Section:

- Tax Law

- Laws Affected:

- Amd §§1101, 1115, 1107, 1109 & 1210, Tax L

- Versions Introduced in Other Legislative Sessions:

-

2009-2010:

S2541, A667

2011-2012: S1089, A5835

2015-2016: S762

2017-2018: S3410

2019-2020: S3588

2021-2022: S3334

2023-2024: S4949

2013-S2635A (ACTIVE) - Summary

Provides a tax exemption from sales and compensating use taxes on alternative energy systems including alternative energy systems, new Energy Star appliances and tangible personal property used in or on habitable residential and non-residential structure to improve energy efficiency; and defines relevant terms; authorizes municipalities to adopt the exemption.

2013-S2635A (ACTIVE) - Sponsor Memo

BILL NUMBER:S2635A

TITLE OF BILL: An act to amend the tax law, in relation to providing

an exemption for alternative energy systems from the state's sales and

compensating use taxes and authorizing counties and cities to elect

such exemption from their sales and use taxes imposed by or pursuant

to the authority of such law; and providing for the repeal of such

provisions upon expiration thereof

PURPOSE:

The legislation provides a tax exemption from sales and compensating

use taxes for alternative energy systems.

SUMMARY OF PROVISIONS:

Identifies alternative energy systems as new Energy Star appliances

and tangible personal property used in or on habitable residential and

nonresidential structures for the purpose of improving energy

efficiency. Such systems include systems which do not rely on

petroleum products or natural gas as their energy source, new Energy

Star appliances, and insulation, weather stripping, and products such

as roofing, windows, doors and skylights approved by the Energy Star

program.

Adds exemptions from sales and use taxes for alternative energy

2013-S2635A (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

2635--A

2013-2014 Regular Sessions

I N S E N A T E

January 23, 2013

___________

Introduced by Sens. PARKER, BONACIC, BRESLIN, KRUEGER, PERKINS, RANZEN-

HOFER, SERRANO, STAVISKY, TKACZYK, VALESKY -- read twice and ordered

printed, and when printed to be committed to the Committee on Investi-

gations and Government Operations -- recommitted to the Committee on

Investigations and Government Operations in accordance with Senate

Rule 6, sec. 8 -- committee discharged, bill amended, ordered

reprinted as amended and recommitted to said committee

AN ACT to amend the tax law, in relation to providing an exemption for

alternative energy systems from the state's sales and compensating use

taxes and authorizing counties and cities to elect such exemption from

their sales and use taxes imposed by or pursuant to the authority of

such law; and providing for the repeal of such provisions upon expira-

tion thereof

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subdivision (b) of section 1101 of the tax law is amended

by adding a new paragraph 39 to read as follows:

(39) ALTERNATIVE ENERGY SYSTEMS, NEW ENERGY STAR APPLIANCES AND TANGI-

BLE PERSONAL PROPERTY USED IN OR ON HABITABLE RESIDENTIAL AND NON-RESI-

DENTIAL STRUCTURES FOR THE PURPOSE OF IMPROVING THE ENERGY EFFICIENCY OF

SUCH STRUCTURES CONSIST OF: (I) SYSTEMS WHICH DO NOT RELY ON PETROLEUM

PRODUCTS OR NATURAL GAS AS THEIR ENERGY SOURCE OR FUEL CELL ELECTRIC

GENERATION EQUIPMENT AS DESCRIBED IN PARAGRAPH TWO OF SUBSECTION (G-2)

OF SECTION SIX HUNDRED SIX OF THIS CHAPTER; (II) NEW ENERGY STAR APPLI-

ANCES, INCLUDING RESIDENTIAL REFRIGERATORS, FREEZERS, CLOTHING WASHERS

(BUT NOT A COMBINATION WASHER/DRYER UNLESS THE CLOTHING IS WASHED AND

DRIED IN THE SAME COMPARTMENT), LIGHT FIXTURES WHICH USE A PIN-BASED

COMPACT FLUORESCENT BULB, NON-COMMERCIAL CEILING FANS OR CEILING FAN AND

LIGHT KITS, DISHWASHER OR AIR CONDITIONERS, SOLD AT RETAIL, PROVIDED

SUCH APPLIANCES QUALIFY FOR AND ARE LABELED WITH, AN ENERGY STAR LABEL

BY THE MANUFACTURER, PURSUANT TO AN AGREEMENT AMONG THE MANUFACTURER,

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD02974-02-4

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.