|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Jan 04, 2012 |

referred to banks |

| Mar 09, 2011 |

reported and committed to finance |

| Feb 28, 2011 |

referred to banks |

Senate Bill S3650

2011-2012 Legislative Session

Sponsored By

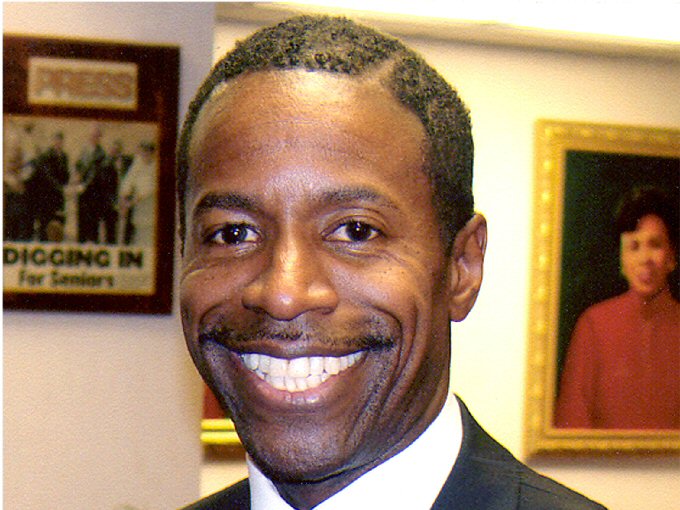

(D, WF) Senate District

Archive: Last Bill Status - In Senate Committee Banks Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

Votes

2011-S3650 (ACTIVE) - Details

- Current Committee:

- Senate Banks

- Law Section:

- Banking Law

- Laws Affected:

- Amd §§18-a & 34, Bank L

- Versions Introduced in Other Legislative Sessions:

-

2009-2010:

S3704

2013-2014: S2873

2011-S3650 (ACTIVE) - Sponsor Memo

BILL NUMBER:S3650

TITLE OF BILL:

An act

to amend the banking law, in relation to the imposition of certain fees

PURPOSE:

To help encourage smaller financial institutions to consider

converting to a state charter by establishing a lower application fee.

SUMMARY OF PROVISIONS:

Section 18-a of the Banking Law is amended to establish a lower

application fee for smaller banks, thrifts and credit unions which

are converting from a federal charter to a state charter.

Section 34 of the Banking Law is amended to provide that the

Superintendent of Banks shall set the fee for service of process

involving foreign banks, provided however that such fee shall not

exceed the fee level established by the Legislature for service of

process upon the Department of State pursuant to section 104-A(c) of

the Business Corporation Law. The bill also provides that no fee

shall be collected for process served on behalf of a municipality.

JUSTIFICATION:

Section 18-a of the Banking Law was added in 2005 to set new fee

levels for applications by banking institutions and financial service

2011-S3650 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

3650

2011-2012 Regular Sessions

I N S E N A T E

February 28, 2011

___________

Introduced by Sen. SMITH -- read twice and ordered printed, and when

printed to be committed to the Committee on Banks

AN ACT to amend the banking law, in relation to the imposition of

certain fees

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subdivision 6 of section 18-a of the banking law is renum-

bered subdivision 7 and a new subdivision 6 is added to read as follows:

6. FOR ANY FEDERAL BANK, SAVINGS BANK, SAVINGS AND LOAN ASSOCIATION OR

CREDIT UNION WHICH HAS LESS THAN ONE HUNDRED MILLION DOLLARS IN ASSETS

AND WHICH IS MAKING AN APPLICATION TO CONVERT INTO A STATE BANK, SAVINGS

BANK, SAVINGS AND LOAN ASSOCIATION OR CREDIT UNION, THE INVESTIGATION

FEE FOR ANY SUCH APPLICATION SHALL BE ONE THOUSAND DOLLARS.

S 2. Section 34 of the banking law, as amended by chapter 310 of the

laws of 1962, is amended to read as follows:

S 34. Superintendent as attorney to accept service of process. When-

ever pursuant to any provision of this chapter, the superintendent shall

have been duly appointed attorney to receive service of process for any

individual, partnership, unincorporated association or corporation, such

service shall be made by personally delivering duplicate copies of the

process to and leaving them with the superintendent or any deputy super-

intendent. Service of process so made shall be deemed to have been made

within the territorial jurisdiction of any court in this state. The

superintendent or deputy superintendent shall forthwith forward by mail,

postage prepaid, a copy of every process served upon him OR HER in

accordance with this section, directed to the person last designated by

such individual, partnership, unincorporated association or corporation

in accordance with the provisions of this chapter to receive such proc-

ess on his OR HER or its behalf. For each service of process upon the

superintendent or a deputy, he OR SHE shall collect [the sum of two

dollars] A FEE AS SET BY THE SUPERINTENDENT, PROVIDED THAT SUCH FEE

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD09854-01-1

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.