|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Jan 04, 2012 |

referred to banks |

| Feb 28, 2011 |

referred to banks |

Senate Bill S3652

2011-2012 Legislative Session

Sponsored By

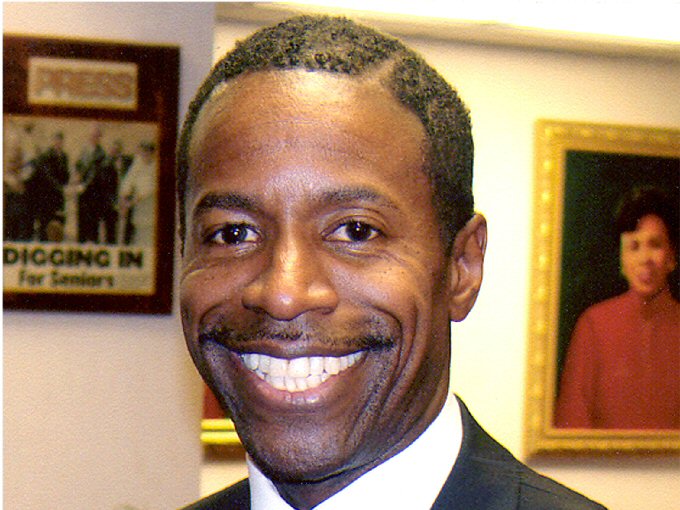

(D, WF) Senate District

Archive: Last Bill Status - In Senate Committee Banks Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

2011-S3652 (ACTIVE) - Details

- See Assembly Version of this Bill:

- A3315

- Current Committee:

- Senate Banks

- Law Section:

- Banking Law

- Laws Affected:

- Amd §14-f, Bank L

- Versions Introduced in Other Legislative Sessions:

-

2009-2010:

S5599, A3072

2013-2014: S6308, A3073

2015-2016: S6242, A4534

2017-2018: S2452, A7617

2019-2020: S2245, A1940

2011-S3652 (ACTIVE) - Sponsor Memo

BILL NUMBER:S3652

TITLE OF BILL:

An act

to amend the banking law, in relation to the number of withdrawal

transactions from a basic banking account

PURPOSE OR GENERAL IDEA OF BILL:

This bill increases the amount of withdrawal transactions allowed at

no additional charge for basic banking account holders aged sixty and

older from eight to twelve.

SUMMARY OF SPECIFIC PROVISIONS:

This bill amends paragraph c of subdivision 2 of section 14-f of the

banking law.

JUSTIFICATION:

As part of the Banking Deregulation Act of 1994, state chartered banks

were required to offer "lifeline" basic checking accounts which

allowed consumers eight free withdrawal transactions (including

checks, bank withdrawals, and withdrawals from a bank's own ATM)

during anyone month billing cycle. The lifeline account was designed

to assist the poorest residents of our state who are required to use

banks to receive their Social Security and SSI payments

electronically. However, senior citizens, who make up the largest

group who use banks for receipt of federal benefits, are also the

2011-S3652 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

3652

2011-2012 Regular Sessions

I N S E N A T E

February 28, 2011

___________

Introduced by Sen. SMITH -- read twice and ordered printed, and when

printed to be committed to the Committee on Banks

AN ACT to amend the banking law, in relation to the number of withdrawal

transactions from a basic banking account

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Paragraph (c) of subdivision 2 of section 14-f of the bank-

ing law, as added by chapter 1 of the laws of 1994, is amended to read

as follows:

(c) eight withdrawal transactions FOR ACCOUNT HOLDERS UNDER SIXTY-FIVE

YEARS OF AGE, AND TWELVE WITHDRAWAL TRANSACTIONS FOR ACCOUNT HOLDERS

SIXTY-FIVE YEARS OF AGE OR OLDER, including those conducted at electron-

ic facilities, during any periodic cycle at no additional charge to the

account holder; and

S 2. This act shall take effect on the sixtieth day after it shall

have become a law.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD06558-01-1

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.