|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| May 31, 2012 |

signed chap.47 |

| May 21, 2012 |

delivered to governor |

| May 07, 2012 |

returned to senate passed assembly ordered to third reading cal.521 substituted for a9123 |

| Jan 19, 2012 |

referred to banks delivered to assembly passed senate |

| Jan 18, 2012 |

advanced to third reading |

| Jan 10, 2012 |

2nd report cal. |

| Jan 09, 2012 |

1st report cal.1 |

| Jan 04, 2012 |

referred to banks returned to senate died in assembly |

| Jun 07, 2011 |

referred to banks delivered to assembly passed senate |

| Jun 06, 2011 |

advanced to third reading |

| Jun 02, 2011 |

2nd report cal. |

| Jun 01, 2011 |

1st report cal.902 |

| Mar 03, 2011 |

referred to banks |

Senate Bill S3779

Signed By Governor2011-2012 Legislative Session

Sponsored By

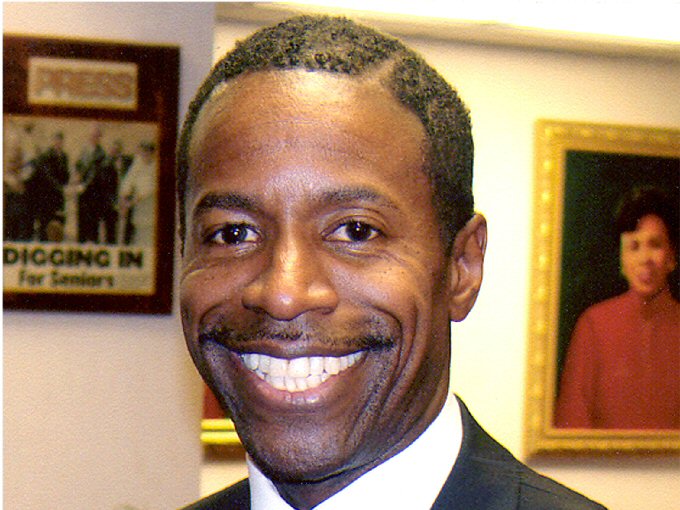

(D, WF) Senate District

Archive: Last Bill Status - Signed by Governor

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

Votes

2011-S3779 (ACTIVE) - Details

2011-S3779 (ACTIVE) - Sponsor Memo

BILL NUMBER:S3779

TITLE OF BILL:

An act to amend the banking law, in relation to the requirement for

licensure to make mortgage loans

PURPOSE:

This bill would tighten the mortgage banker licensing exemption,

thereby helping to prevent and address problems resulting from

unregulated residential mortgage loans which are not subject to

existing consumer protections.

SUMMARY:

Section 590(2) of the Banking Law -- which currently exempts from the

mortgage banker licensing requirement any person or entity that does

not make five or more personal mortgage loans in a calendar year is

amended so that the exemption applies only to a person or entity which

makes not more than three loans in a calendar year, or more than five

in a two year period. This subdivision is also amended to provide that

an entity shall not be exempt if any loan is made which was solicited,

processed, placed or negotiated by a mortgage broker, mortgage banker

or exempt organization.

Section 590(5) (b) is amended to provide that mortgage brokers may

solicit, process, place and negotiate mortgage loans only with a

mortgage banker or exempt organization, thereby prohibiting

2011-S3779 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

3779

2011-2012 Regular Sessions

I N S E N A T E

March 3, 2011

___________

Introduced by Sen. SMITH -- read twice and ordered printed, and when

printed to be committed to the Committee on Banks

AN ACT to amend the banking law, in relation to the requirement for

licensure to make mortgage loans

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Paragraph (a) of subdivision 2 of section 590 of the bank-

ing law, as amended by chapter 472 of the laws of 2008, is amended to

read as follows:

(a) No INDIVIDUAL, person, partnership, association, corporation or

other entity shall engage in the business of making [five or more] mort-

gage loans [in any one calendar year] without first obtaining a license

from the superintendent in accordance with the licensing procedure

provided in this article and such regulations as may be promulgated by

the banking board or prescribed by the superintendent. The licensing

provisions of this subdivision shall not apply to: (I) any exempt organ-

ization [nor to]; (II) any entity or entities which shall be exempted in

accordance with regulations promulgated by the banking board hereunder;

OR (III) ANY INDIVIDUAL, PERSON, PARTNERSHIP, ASSOCIATION, CORPORATION

OR OTHER ENTITY WHICH MAKES NOT MORE THAN THREE SUCH LOANS IN A CALENDAR

YEAR, NOR MORE THAN FIVE IN A TWO YEAR PERIOD, PROVIDED THAT NO SUCH

MORTGAGE LOANS HAVE BEEN MADE WHICH WERE SOLICITED, PROCESSED, PLACED OR

NEGOTIATED BY A MORTGAGE BROKER, MORTGAGE BANKER OR EXEMPT ORGANIZATION.

S 2. Paragraph (b) of subdivision 5 of section 590 of the banking law,

as amended by chapter 472 of the laws of 2008, is amended to read as

follows:

(b) Mortgage brokers shall solicit, process, place and negotiate mort-

gage loans WITH A MORTGAGE BANKER LICENSED PURSUANT TO THE PROVISIONS OF

THIS ARTICLE OR EXEMPT ORGANIZATION AS DEFINED HEREIN OR PURSUANT TO

REGULATIONS AS PROMULGATED BY THE BANKING BOARD OR PRESCRIBED BY THE

SUPERINTENDENT AND in conformity with the provisions of this chapter,

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD09853-01-1

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.