|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Jan 08, 2014 |

referred to banks |

| Mar 05, 2013 |

referred to banks |

Senate Bill S4036

2013-2014 Legislative Session

Sponsored By

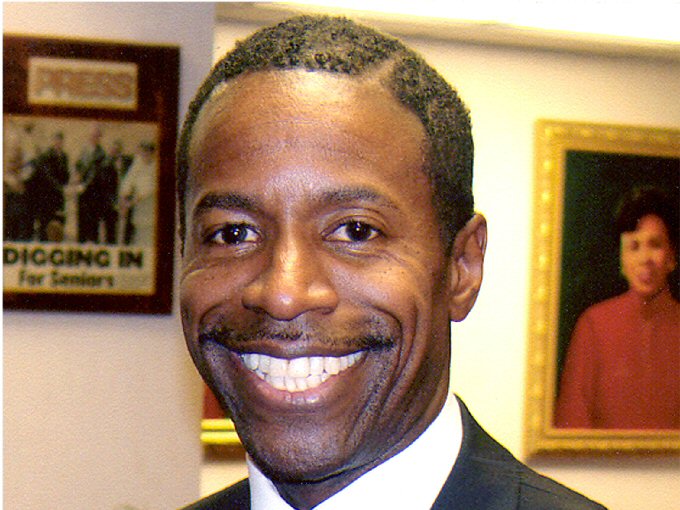

(D, WF) Senate District

Archive: Last Bill Status - In Senate Committee Banks Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

2013-S4036 (ACTIVE) - Details

- See Assembly Version of this Bill:

- A2962

- Current Committee:

- Senate Banks

- Law Section:

- Banking Law

- Laws Affected:

- Add §202-k, Bank L; add §5-532, Gen Ob L

- Versions Introduced in Other Legislative Sessions:

-

2009-2010:

A1484

2011-2012: A3288

2015-2016: S4458, A9603

2017-2018: S3699

2019-2020: S3241

2021-2022: S5774

2023-2024: S2649

2013-S4036 (ACTIVE) - Summary

Prohibits foreign banking corporations from issuing payday loans; defines payday loans as any transaction in which a short-term cash advance is made to a consumer in exchange for (i) a consumer's personal check or share draft, in the amount of an advance plus a fee, where presentment or negotiation of such check or share draft is deferred by agreement of the parties until a designated future date; or (ii) a consumer's authorization to debit the consumer's transaction account, in the amount of the advance plus a fee, where such account will be debited on or after a designated future date.

2013-S4036 (ACTIVE) - Sponsor Memo

BILL NUMBER:S4036

TITLE OF BILL: An act to amend the banking law and the general

obligations law, in relation to prohibiting foreign banking

corporations from engaging in high-cost payday loans

PURPOSE OR GENERAL IDEA OF BILL:

To prohibit foreign banking corporations from issuing payday loans.

SUMMARY OF SPECIFIC PROVISIONS:

Amends § 202 of the Banking Law and § 5 of the general obligations law

to accomplish the above stated purpose.

EXPLANATION OF THE LEGISLATION:

Banking corporations that are outside of New York should be prohibited

from making payday loans because the annual percentage rates on these

loans are astronomical, many lenders use shady tactics to collect

payments, and they also target those with low income. According to

recent studies the predatory lending industry has been rapidly growing

across the country. This includes payday loan companies which offer

small sum, short-term, high-rate, unsecured personal loans. These

loans go by many names, including "payday loans," "cash advance

loans," "postdated check loans" or "deferred deposits." Payday lenders

2013-S4036 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

4036

2013-2014 Regular Sessions

I N S E N A T E

March 5, 2013

___________

Introduced by Sen. SMITH -- read twice and ordered printed, and when

printed to be committed to the Committee on Banks

AN ACT to amend the banking law and the general obligations law, in

relation to prohibiting foreign banking corporations from engaging in

high-cost payday loans

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. The banking law is amended by adding a new section 202-k to

read as follows:

S 202-K. PROHIBITION OF PAYDAY LOANS. 1. NO FOREIGN BANKING CORPO-

RATION SHALL MAKE ANY PAYDAY LOAN, EITHER DIRECTLY OR INDIRECTLY, OR

MAKE ANY LOAN TO ANY OTHER LENDER FOR PURPOSES OF FINANCING A PAYDAY

LOAN OR REFINANCING OR EXTENDING ANY PAYDAY LOAN.

2. FOR PURPOSES OF THIS SECTION "PAYDAY LOAN" MEANS ANY TRANSACTION IN

WHICH A SHORT-TERM CASH ADVANCE IS MADE TO A CONSUMER IN EXCHANGE FOR

(I) A CONSUMER'S PERSONAL CHECK OR SHARE DRAFT, IN THE AMOUNT OF AN

ADVANCE PLUS A FEE, WHERE PRESENTMENT OR NEGOTIATION OF SUCH CHECK OR

SHARE DRAFT IS DEFERRED BY AGREEMENT OF THE PARTIES UNTIL A DESIGNATED

FUTURE DATE; OR (II) A CONSUMER'S AUTHORIZATION TO DEBIT THE CONSUMER'S

TRANSACTION ACCOUNT, IN THE AMOUNT OF THE ADVANCE PLUS A FEE, WHERE SUCH

ACCOUNT WILL BE DEBITED ON OR AFTER A DESIGNATED FUTURE DATE.

S 2. The general obligations law is amended by adding a new section

5-532 to read as follows:

S 5-532. PROHIBITION ON PAYDAY LOANS. 1. A CREDITOR MAY NOT MAKE A

PAYDAY LOAN TO ANY PERSON IF THE CREDITOR KNOWS OR HAS REASONABLE CAUSE

TO BELIEVE THAT:

A. THE PERSONAL CHECK OR SHARE DRAFT THE CREDITOR RECEIVES FROM THE

PERSON, IN EXCHANGE FOR THE LOAN, IS DRAWN ON AN INSURED DEPOSITORY

INSTITUTION OR INSURED CREDIT UNION; OR

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD00596-01-3

S. 4036 2

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.