|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Jun 12, 2014 |

referred to ways and means delivered to assembly passed senate |

| Jun 02, 2014 |

advanced to third reading |

| May 29, 2014 |

2nd report cal. |

| May 28, 2014 |

1st report cal.972 |

| Jan 08, 2014 |

referred to investigations and government operations |

| Oct 25, 2013 |

referred to rules |

Senate Bill S5970

2013-2014 Legislative Session

Sponsored By

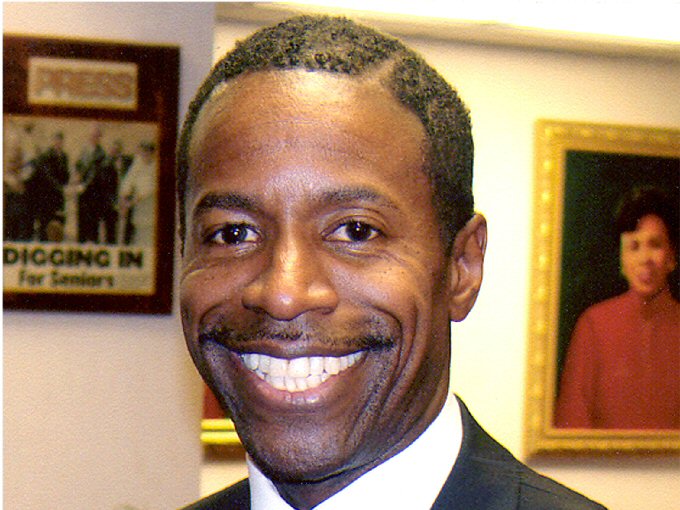

(R, C, IP, RFM) 24th Senate District

Archive: Last Bill Status - In Assembly Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

Votes

co-Sponsors

(D) 15th Senate District

(D) Senate District

(D) Senate District

(D) 22nd Senate District

2013-S5970 (ACTIVE) - Details

2013-S5970 (ACTIVE) - Sponsor Memo

BILL NUMBER:S5970

TITLE OF BILL: An act to amend the tax law, in relation to granting

an exemption from the tax on mortgages for residential real property

purchased by persons receiving federal and/or state buyouts of their

residence as a result of damage caused by hurricane Sandy in October

of 2012; and providing for the repeal of such provisions upon

expiration thereof

PURPOSE: Exempts mortgages of residential real property from taxation

when property is purchased by owners receiving state or federal buyout

of prior residence destroyed in hurricane Sandy

SUMMARY OF PROVISIONS:

Section 1 amends the opening paragraph of section 252 of the tax law

is designated subdivision 1 and a new subdivision 2 is added. Section

2 is the effective date.

JUSTIFICATION: In the wake of Hurricane Sandy, an effort has been

undertaken to ensure that shoreline protections are implemented. In

some cases it has been determined, in consultation with residents,

that certain homes and communities will be eligible for a buyout of

their property, with the intent of providing for better storm

protections and a more resilient housing stock in the future. In many

cases where a homeowner does make the difficult decision to leave the

2013-S5970 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

5970

2013-2014 Regular Sessions

I N S E N A T E

October 25, 2013

___________

Introduced by Sens. LANZA, AVELLA, KLEIN, SAVINO, SMITH -- read twice

and ordered printed, and when printed to be committed to the Committee

on Rules

AN ACT to amend the tax law, in relation to granting an exemption from

the tax on mortgages for residential real property purchased by

persons receiving federal and/or state buyouts of their residence as a

result of damage caused by hurricane Sandy in October of 2012; and

providing for the repeal of such provisions upon expiration thereof

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. The opening paragraph of section 252 of the tax law is

designated subdivision 1 and a new subdivision 2 is added to read as

follows:

2. (A) NOTWITHSTANDING THE PROVISIONS OF SUBDIVISION ONE OF THIS

SECTION, THE GOVERNING BODY OF ANY MUNICIPALITY ACTING THROUGH ITS LOCAL

LEGISLATIVE BODY OR OTHER GOVERNING AGENCY, IS HEREBY AUTHORIZED AND

EMPOWERED TO ADOPT AND AMEND LOCAL LAWS OR ORDINANCES TO EXEMPT FROM THE

TAXES IMPOSED BY THIS ARTICLE THE MORTGAGE OF RESIDENTIAL REAL PROPERTY,

WHEN SUCH REAL PROPERTY IS PURCHASED AND IS TO BE OCCUPIED BY AN OWNER

OR OWNERS WHO HAVE RECEIVED, OR FOR WHOM A FINAL DETERMINATION HAS BEEN

MADE AND WILL RECEIVE, FEDERALLY AND/OR STATE FUNDED BUYOUTS OF SUCH

OWNER OR OWNERS' PREVIOUS RESIDENTIAL REAL PROPERTY WHICH WAS DAMAGED OR

DESTROYED AS A RESULT OF HURRICANE SANDY DURING OCTOBER OF TWO THOUSAND

TWELVE.

(B) ANY PERSON WHO AFTER OCTOBER TWENTY-SECOND, TWO THOUSAND TWELVE

AND BEFORE THE EFFECTIVE DATE OF THIS SUBDIVISION, WHO WOULD OTHERWISE

QUALIFY UNDER PARAGRAPH (A) OF THIS SUBDIVISION, AND WHO HAS PAID ANY

TAXES IMPOSED BY THIS ARTICLE, SHALL BE ENTITLED TO RECEIVE A REIMBURSE-

MENT OF ALL SUCH TAXES PAID FROM THE COUNTY CLERK OR COUNTY TREASURER OF

THE RESPECTIVE COUNTY WHERE SUCH TAXES WERE PAID IN THE SAME MANNER AS

PROVIDED IN SECTION TWO HUNDRED FIFTY-SEVEN-A OF THIS ARTICLE.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD11891-02-3

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.