|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Mar 10, 2014 |

notice of committee consideration - requested |

| Jan 24, 2014 |

referred to labor |

Senate Bill S6455

2013-2014 Legislative Session

Sponsored By

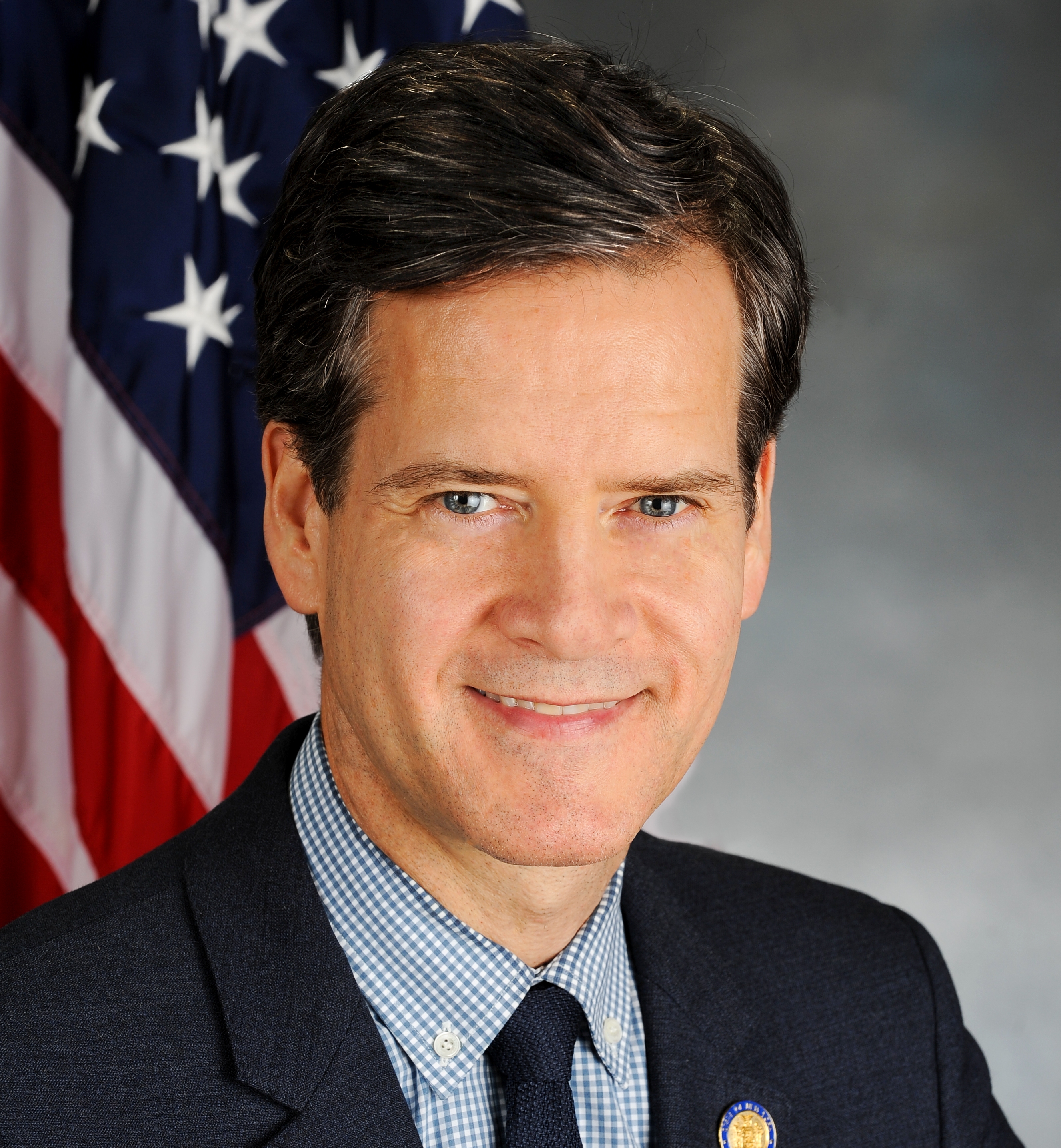

(D, WF) Senate District

Archive: Last Bill Status - In Senate Committee Labor Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

co-Sponsors

(D) Senate District

(D, WF) 47th Senate District

(D, WF) 28th Senate District

(D, WF) 21st Senate District

2013-S6455 (ACTIVE) - Details

- See Assembly Version of this Bill:

- A9386

- Current Committee:

- Senate Labor

- Law Section:

- Labor Law

- Laws Affected:

- Add Art 19-D §§696 - 696-e, Lab L

- Versions Introduced in Other Legislative Sessions:

-

2015-2016:

S152

2017-2018: S2035, S7015

2013-S6455 (ACTIVE) - Sponsor Memo

BILL NUMBER:S6455

TITLE OF BILL: An act to amend the labor law, in relation to establish-

ing a living wage rate

PURPOSE OR GENERAL IDEA OF THE BILL:

This bill would require large employers and chain stores in New York

State to pay a defined living wage - $15 - indexed to inflation.

SUMMARY OF SPECIFIC PROVISIONS:

Section 1 establishes A new article 19-D to be added to the Labor Law

creating the "Fair Wages Act."

Provides definitions for "employer," "formula retail store," "large

employer," "manufacturing," "not-for-profit organization," "transporta-

tion business," "franchisee or subcontractor," "employee," and "living

wage rate."

Establishes the living wage rate at fifteen dollars an hour. In addi-

tion, it establishes wage increases indexed to consumer price index -

all urban consumers, CPI-u, or a successor index as calculated by the

U.S. Dept of Labor.

States an employer must pay employees an hourly wage of no less than the

2013-S6455 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

6455

I N S E N A T E

January 24, 2014

___________

Introduced by Sen. SQUADRON -- read twice and ordered printed, and when

printed to be committed to the Committee on Labor

AN ACT to amend the labor law, in relation to establishing a living wage

rate

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. The labor law is amended by adding a new article 19-D to

read as follows:

ARTICLE 19-D

FAIR WAGES ACT

SECTION 696. DEFINITIONS.

696-A. LIVING WAGE RATE.

696-B. PAYMENT OF LIVING WAGE.

696-C. IMPLEMENTATION.

696-D. COMMISSIONER'S POWERS OF INVESTIGATION.

696-E. CIVIL ACTION.

S 696. DEFINITIONS. FOR THE PURPOSES OF THIS ARTICLE, THE TERM:

1. "EMPLOYER" MEANS A FORMULA RETAIL STORE, LARGE EMPLOYER, TRANSPOR-

TATION BUSINESS, OR FRANCHISEE OR SUBCONTRACTOR, AND INCLUDES ANY INDI-

VIDUAL, PARTNERSHIP, ASSOCIATION, CORPORATION, LIMITED LIABILITY COMPA-

NY, BUSINESS TRUST, LEGAL REPRESENTATIVE, OR ANY ORGANIZED GROUP OF

PERSONS ACTING AS EMPLOYER.

2. "FORMULA RETAIL STORE" MEANS ANY EMPLOYER THAT OPERATES A RETAIL

SALES OR RESTAURANT ESTABLISHMENT EITHER DIRECTLY OR THROUGH FRANCHISEES

AND THAT, ALONG WITH ELEVEN OR MORE OTHER RETAIL SALES OR RESTAURANT

ESTABLISHMENTS LOCATED IN THE UNITED STATES, MAINTAINS TWO OR MORE OF

THE FOLLOWING FEATURES: (A) A STANDARDIZED ARRAY OF MERCHANDISE, A

STANDARDIZED FACADE, A STANDARDIZED DECOR AND COLOR SCHEME, A UNIFORM

APPAREL, STANDARDIZED SIGNAGE, A TRADEMARK; OR (B) A SERVICEMARK.

3. "LARGE EMPLOYER" MEANS ANY EMPLOYER THAT HAS ANNUAL GROSS REVENUE

OF FIFTY MILLION DOLLARS OR MORE, BUT SHALL NOT INCLUDE (A) AN EMPLOYER

WHOSE PRINCIPAL INDUSTRY IS MANUFACTURING; OR (B) A NOT-FOR-PROFIT

ORGANIZATION. AN EMPLOYER SHALL BE DEEMED TO HAVE ANNUAL GROSS REVENUE

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD13688-03-4

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.