|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Feb 10, 2012 |

referred to finance |

Senate Bill S6459

2011-2012 Legislative Session

Sponsored By

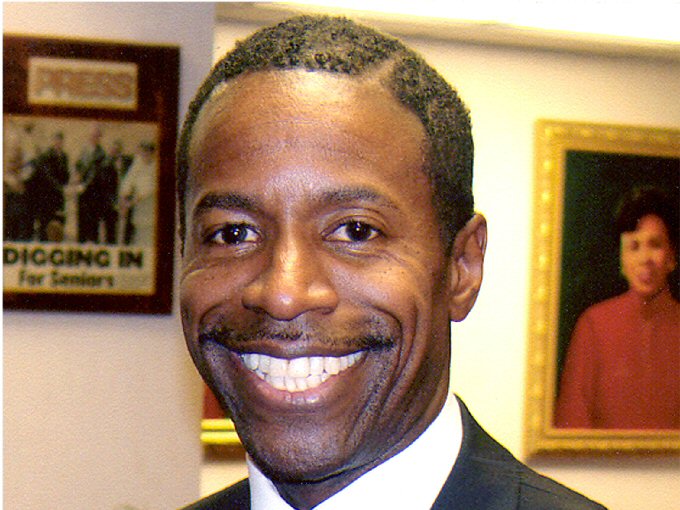

(D, WF) Senate District

Archive: Last Bill Status - In Senate Committee Finance Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

co-Sponsors

(D) Senate District

(D, WF) Senate District

2011-S6459 (ACTIVE) - Details

- Current Committee:

- Senate Finance

- Law Section:

- State Finance Law

- Laws Affected:

- Add §97-llll, St Fin L

2011-S6459 (ACTIVE) - Summary

Establishes the New York state mortgage settlement fund to consist of monies obtained by the state as a result of settlement with mortgage servicers to be used to compensate eligible homeowners who have been injured by foreclosure abuses; provides that homeowners eligible to receive compensation as a result of such settlement may elect certain bases for calculating such compensation; provides that eligible homeowners may request treble damages.

2011-S6459 (ACTIVE) - Sponsor Memo

BILL NUMBER:S6459

TITLE OF BILL:

An act

to amend the state finance law, in relation to establishing the New York

state mortgage settlement fund

PURPOSE:

To authorize the New York State Comptroller to establish a special

fund to be known as the New York state mortgage settlement fund.

JUSTIFICATION:

In the fall of 2008 New York State and the entire country was reeling

from an onslaught of residential foreclosures which from the

beginning of 2007 to early 2012 saw roughly four million families

lose their homes to foreclosure.

The devastating toll this epidemic took on the country left families

shaken and America's financial system on the brink of collapse. The

foreclosure situation was further exacerbated by evidenced emerging

that the foreclosure process was possibly corrupted by careless

recordkeeping, cut corners and potential fraud, typified by

high-profile cases of "robo-signing" - cases in which foreclosures

took place based on forged or unreviewed documents.

These series of events led to state attorneys general from across the

country bringing mortgage lenders to the negotiating table to address

2011-S6459 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

6459

I N S E N A T E

February 10, 2012

___________

Introduced by Sen. SMITH -- read twice and ordered printed, and when

printed to be committed to the Committee on Finance

AN ACT to amend the state finance law, in relation to establishing the

New York state mortgage settlement fund

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. The state finance law is amended by adding a new section

97-1111 to read as follows:

S 97-1111. NEW YORK STATE MORTGAGE SETTLEMENT FUND. 1. THERE IS HEREBY

ESTABLISHED IN THE CUSTODY OF THE STATE COMPTROLLER A SPECIAL FUND TO BE

KNOWN AS THE NEW YORK STATE MORTGAGE SETTLEMENT FUND.

2. SUCH FUND SHALL CONSIST OF ALL MONIES OBTAINED BY THE STATE AS A

RESULT OF ANY AND ALL SETTLEMENTS NEGOTIATED WITH, BY OR ON BEHALF OF

NEW YORK STATE WITH THE MORTGAGE SERVICERS, ANY OTHER MONEYS RECEIVED IN

LIEU OF SUCH AGREEMENT, AND ALL OTHER MONEYS APPROPRIATED, CREDITED OR

TRANSFERRED THERETO PURSUANT TO LAW.

3. MONIES IN THE NEW YORK STATE MORTGAGE SETTLEMENT FUND SHALL BE KEPT

SEPARATE AND SHALL NOT BE COMMINGLED WITH ANY OTHER MONIES IN THE CUSTO-

DY OR CONTROL OF THE STATE COMPTROLLER.

4. FOR PURPOSES OF THIS SECTION, THE FOLLOWING TERMS SHALL HAVE THE

FOLLOWING MEANINGS:

(A) "MASTER SETTLEMENT AGREEMENT" SHALL MEAN THE SETTLEMENT AGREEMENT

AND RELATED DOCUMENTS ENTERED INTO IN THE YEAR TWO THOUSAND TWELVE BY

THE STATE AND PARTICIPATING MORTGAGE SERVICERS.

(B) "MORTGAGE SERVICER" SHALL HAVE THE SAME MEANING AS PARAGRAPH (H)

OF SUBDIVISION ONE OF SECTION FIVE HUNDRED NINETY OF THE BANKING LAW.

(C) "PARTICIPATING MORTGAGE SERVICER" SHALL MEAN EACH MORTGAGE SERVI-

CER THAT ENTERED INTO THE MASTER SETTLEMENT AGREEMENT WITH THE STATE,

INCLUDING ALLY/GMAC, BANK OF AMERICA, CITI, JPMORGAN CHASE AND WELLS

FARGO.

(D) "ELIGIBLE HOMEOWNER" SHALL MEAN ANY RESIDENT OF THIS STATE WHO

CURRENTLY OWNS AND RESIDES OR DID OWN AND RESIDE IN QUALIFYING RESIDEN-

TIAL REAL PROPERTY, WHO THE COMMISSIONER DETERMINES, PURSUANT TO THE

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD14624-01-2

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.